How rich must you be to afford “affordable” housing?

After many people – including West Hampstead Life – made a fuss about the lack of affordable housing provision in the Liddell Road scheme, Camden promised that the 156 West End Lane scheme would meet the 50% affordable housing quota by floorspace.

The development, which was given the go-ahead by the planning committee on Thursday, ended up with 79 affordable flats, or 49.8% of floorspace. Except, you could argue it’s not even that.

Take a deep breath as we dive into the murky waters of what is and isn’t affordable housing – and quite how much money you need to get some for yourself.

First, the good news.

Of those 79 affordable flats, 44 are “affordable rented” (and equate to 30% of total floorspace). According to the planning officer’s report, the rents have been set at Camden’s target social rented rate. In 2014/15, the average cost of Camden council’s housing rent was £475 per month. To give you an idea of how that relates to the local private rental market, one-bed flats in the area on Rightmove start from about £1,250 per month.

You can therefore argue that these rented properties are indeed affordable.

Now the bad news.

The remaining 35 units (20% of total floorspace) are ‘shared ownership’ properties. This still nominally falls under so-called “intermediate” affordable housing. Intermediate includes both affordable rented and shared-ownership but excludes social housing (aka “council houses”), which is a separate category. There is no social housing planned for 156 West End Lane.

How affordable is shared ownership? We looked at the nearby Central development on Iverson Road where a one-bed shared-ownership flat is being marketed.

If you’re not familiar with the concept of shared ownership – as at least a couple of councillors on Thursday night were clearly not – then here’s the primer:

Shared ownership means you take a stake (often 25%) in the property and any mortgage you need is based on that value. You then pay rent on the remaining share (say, 75%) to the housing association that manages the property. There are also service charges. Over time, most people try to increase their stake. The scheme is supposed to be a way to get ownership with much lower financial requirements. Typically a deposit of only 5% is required.

Let’s go back to this Iverson Road property to see what it would cost.

The full market price of the flat is £550,000. A 25% share is £137,500. There’s a required 5% deposit of £6,875.

Critically, the details specify a minimum household income of £65,000. Shared ownership schemes in London are available to anyone with a household income below £90,000. For this one, you must also be a Camden resident and almost certainly a first-time buyer (the rules here are not black & white).

The median gross income in Camden is £39,610 (higher than the London average of £33,203) [Source].

Therefore, a Camden couple who both earned the average income would have a combined gross income of £79,220, and would be eligible to buy this property. Note that the average London-wide income would only just make them eligible.

They have got their deposit together and need to borrow £130,625. Shared ownership mortgages are a specific product. We have used the Leeds Building Society shared ownership mortgages to calculate the costs.

At current rates, a 3-yr fixed over a 25-year period, reverting to the standard-variable rate after 3 years and with no fees, works out at an overall rate of 5.3%. According to the Moneysavingexpert site, this leads to an average monthly payment of £787.

But remember, that’s just on the 25% you own. Our average Camden couple have then got to pay rent on the remaining 75% and Origin tells us that this is £688/month, plus a £150 monthly service charge.

Total monthly payment: £1,625.

That’s a high monthly payment for a quarter of a flat. There are standard 25-year mortgages available at the moment with representative APRs of 1.5% (they require 20% deposits). Take one of those and you could borrow £400,000 and end up with the same monthly payment of ~£1,600. The cheapest 1-bed flat (not studio) in the area is on for £279,950, but if you wanted that nice Iverson Road flat at market value you’d still need to find a £150,000 deposit on top of your £400k mortgage. The system works therefore at one level – it makes property affordable for people who otherwise couldn’t possibly afford it.

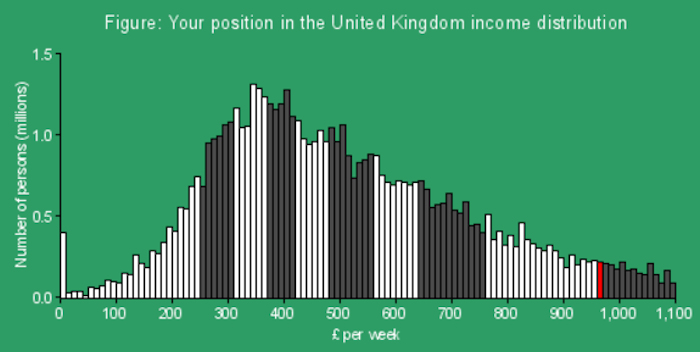

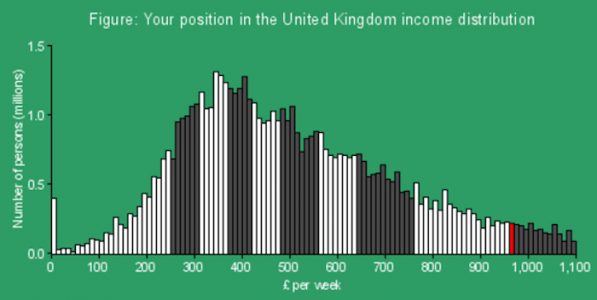

Nevertheless, to get that “affordable” flat in Iverson Road under the shared-ownership scheme, you still need to have a household income equal to two median Camden incomes, and pay out £1,625 a month. For 25% of it. And if you’re wondering, a joint income of £65,000 (assuming you both earned £32,500 each and had no dependents) would place your household in the top 11% of household incomes in the country according to the IFS. Our average Camden couple would be in the top 7%.

The red bar on the right shows a gross household income of £65,000 (net £50,000) relative to national household incomes (based on two adults each earning £32,500).

Is there a solution?

Camden seems to already recognise that affordable renting is far more affordable than shared ownership. According to the 156 report, in April 2016, the council’s cabinet stated that it would “seek to secure affordable intermediate housing… by encouraging all developers and housing associations to provide intermediate rent rather than shared ownership units as the intermediate housing element of their affordable housing contribution to developments’ [our emphasis].

This development was a test of this new strategy but clearly it’s not working.

Indeed, the report for 156 West End Lane suggests that our calculations above could wildly underestimate what a shared ownership flat might cost: “[The] increase in property values has meant that it is no longer possible to deliver shared ownership at a price that is affordable to the council’s target income groups earning £30,000 to £40,000 per year.”

Back to 156 West End Lane. On the basis of what is called “affordable housing”, yes, Camden has delivered 50%. In terms of what a reasonable person might consider to be affordable – perhaps not.

We welcome comments from council officers, or housing associations to correct any assumptions we’ve made here.

Via a FOI request, SWH-STB received the pre-application advice given to A2Dominion from the Senior Camden Planner – who was subsequently ‘moved aside’ from the 156 WEL development – where it was stated:

Affordable housing

The key issue is the affordability of the affordable housing proposed, particularly in

the intermediate elements. Given the land values in the borough shared

ownership is pretty much impossible to make work viably within the income caps,

so it will be necessary to have to look at other models.

Note: Necessary. Note: Totally ignored by the developers.

Not sure i understand why you’re comparing Camden incomes with those of the rest of the country (‘a joint income of £65,000 (assuming you both earned £32,500 each and had no dependents) would place your household in the top 11% of household incomes in the country’).

It seems like households who can afford shared ownership actually have incomes around the Camden average and if true…then i don’t see a huge issue here?

Couple of reasons – we only have Camden’s median income; debatable how good a measure that is given it’s a borough of extremes; and by this token then 50% of people don’t qualify for a housing scheme that is supposed to make housing accessible. Totally accept the piece would benefit from richer data on income distribution.

Second, it is simply interesting to see how out of whack London is with the rest of the country.

I think median is less affected by outliers at the extremes than a straight average. Anyway…even if the scheme focuses around those in the 50th percentile, then it’s a success in the sense that it gives local folks much more of a chance to get on the housing ladder (if that’s what they want).

That said…given current valuations favor renting over buying, i reckon there should be a higher share of ‘affordable rented’ at 156. The UK should be more like Germany which has a much lower home ownership rate (~55% v 65%) but its obsession with property will probably get in the way…

I’d rather see a modal range as an average.

Totally agree with you about rental. As does Camden it appears, which says it should “seek to secure affordable intermediate housing… by encouraging all developers and housing associations to provide intermediate rent rather than shared ownership units”.

But then seems unwilling or unable to implement its own strategy.

See point above about how gvt cut subsidy for social housing from £120k per unit to £30k per unit.

The other Whampstead adds, I appreciate your point and it’s a good one, but in an effort to be balance we have perhaps been too balance. For example if the buyer were single (and over 40% of households are single, divorced or widowed ) it would be unaffordable. Even a couple with their joint incomes they would only just be able to afford 25% of a shared-ownership and shared-ownership only really works if their income is set to rise even future to allow then to staircase up; otherwise it can become a trap. So with 156 there is housing for a few of those on for those on the Council housing waiting lists and for those in the top – but nothing for the vast majority in between? It’s a tough situation and it needs tough choices. Claiming to reach 50% affordable housing in a scheme when a big chunk of that, by the council’s own admission, isn’t affordable, is taking the easy ‘spin’ option, not the tough one. As you say it would be more effective for Housing Associations to offer affordable rents

shared ownership is assured tenancies under Housing Act 1988 for term of lease and can be evicted for

some rent arrears

persistent late payment of rent

breach of tenancy agreement

antisocial behaviour

damage to the property

not occupying as principal home etc..

Many of these rules are set by government and since 2010 it has pulled subsidy from affordable homes decreasing the number which can be built on each private site so the choice is to have policy-compliant developments with more shared-ownership or not much at all.

That may well be true for private sites. The main issue in West Hampstead in recent years is the development of Council-owned sites (ie publicly owned land). We all realise the Council needs to raise money, but – when it comes to land it owns – it does have choices. For example, it could have specified 50% affordable rent at 156 West End Lane; it could have kept ownership of the freehold of the 156 WEL site; it could have provided more than 4% affordable housing at Liddell Road; it could have chosen not to make a £4 million profit from the Liddell Road development, etc. Yes, difficult decisions have to made in the current climate – but it’s wrong to put all the blame on central government.

In 2012 or thereabouts, the government cut the affordable housing subsidy from £120k per unit to £30k per unit, so less social housing could be afforded on each development so there could have been more than 4% on Liddell Road and there could have been more social rented at 156. Trust me we genuinely would have loved more social rented homes (i.e. in line with our borough-wide policy).

Liddell Road was done to build a local school, which TBH you really should mention rather than just talk about 4% homes. The council did take a receipt, but to describe it as ‘profit’ neglects the fact that £25m worth of council investment has gone into schools in NW6 (£10m+ more than Liddell Road school) – where exactly do you think this money comes from? This is money the council stepped in with after the central gvt capital cuts of 2010 totalling £220m+ across 54 schools.

I wrote about it at the time here http://theoblackwell.blogspot.co.uk/2015/02/west-hampstead-benefits-from-huge.html

So I’m sorry I do place a lot of blame on the government, because they starved capital budgets from 2011 onwards but I know it’s easier for the NDF to see the council as boo-boys here, so…

Thanks for the reply, although it’s not the case that the Council is completely powerless in these decisions about land it owns and is selling for multi-million pound sums (far exceeding the spending on schools in the area). It’s widely known in WH that the Liddell Road development includes new school buildings, but happy to add that for clarity. In terms of the £4m profit (aka surplus/receipt) – this was regularly discussed by council officers and councillors at the time of the planning application, so was and is very much part of the debate about Council sites in WH.

Overall, our main point remains: reducing every discussion to a “central government bad, Camden Council good” narrative is somewhat simplistic.

Thanks & agree the council has agency but we can’t ignore gvt rules antipathetic to social housing so I’m pointing out the reality (and not doing so in anymore political terms than the facts dictate) that (a) the amount of social housing is in large part determined by amount of subsidy, which has been cut ervy substantially (something that is rarely reflected on these pages) and (b) surplus raised is reinvested in public services along the principle that housing receipts (mainly from regeneration, not sales) fund new council housing and ‘general fund land’ funds schools and some community facilities. So yes the council is generating a surplus (what you call a ‘profit’) but to reinvest.

The only exception to this is where the sale of old offices in King’s Cross, Camden Town and West Hampstead funded new central offices. The aim here was to bring all staff together, reform some of the old departments, invest in IT and make the council more efficient to run: benefitting all taxpayers. But mindful of housing priorities, on these sites we were keen to see 50% affordable achieved on office sites we sold – and have done so in NW6 and Camden Town (probably at the expense of a larger £ receipt). The regeneration of the Holborn/Cockpit Yard site (which doesn’t involve sale) is along the same lines – 35% affordable plus a new public library.

In total I think this brings in about 200+ affordable homes.