Bringing West Hampstead insight to national property statistics

Sponsored post

Every week newspaper headlines vary between ‘house prices rise’ or ‘house prices fall’ – but which headline is accurate?

We thought we’d delve behind the headlines for this month’s West Hampstead Life column; we’ll be sharing some interesting stats and sprinkling them with some local insight to bring them to life.

First-time buyers

Nationally, the number of first-time buyers is down compared to 20 years ago, and according to the English Housing Survey, the average age of first-time buyers now stands at 33 years old. However, although there is no question that the average age of first-time buyers has steadily increased over the years with a direct correlation to property price inflation, the reality is more nuanced. That’s because the age at which someone buys for the first time is dependent on their personal circumstances.

For example, we receive many enquiries from first-time buyers who are getting considerable support from their parents. In these instances, parents either have cash or equity they can release from the family home, therefore bridging the affordability gap for their children who only need to take out a mortgage for an amount that’s affordable to them.

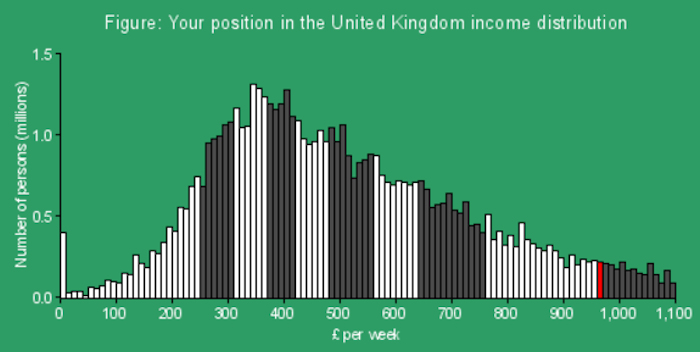

First-time buyers in this scenario typically live at home and are in the early stages of their first job after completing a degree. This gives an average first-time buyer age of around mid- to late-20s, a stark contrast to the majority of first-time buyers whose parents can’t raise such a large amount of ‘spare’ cash – and therefore spend years saving for a deposit whilst renting. For this self-sufficient majority, the average age is early- to mid-30s.

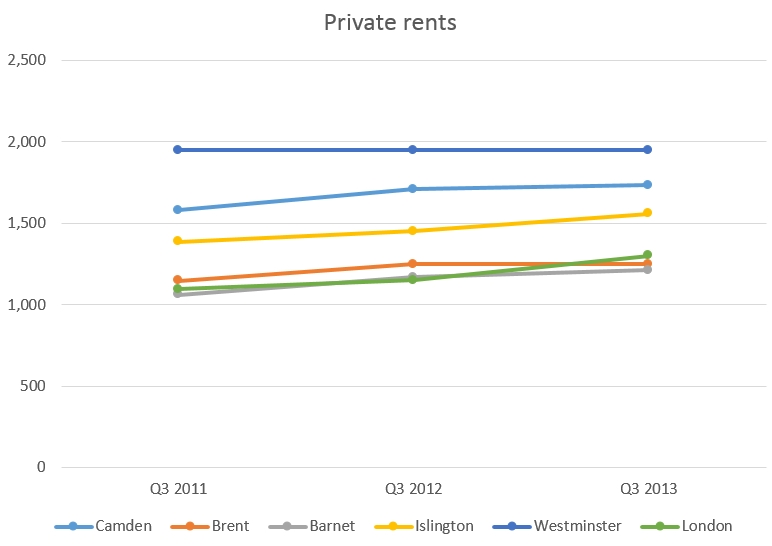

Private rented sector

Nationally, 4.5 million households rent in the private sector, and that figure is likely to grow (with many developers now choosing to build specifically to rent rather than sell). On average the weekly rent in London is £309, but in West Hampstead it’s around the £430 mark. Despite it costing more than average to live in West Hampstead, we’ve found that local tenants pay less in rent as a percentage of their income, compared to the wider London market.

In general, the number of families living in the private rented sector has grown significantly over the last decade. Although we haven’t seen this too much in West Hampstead, there has been an increase in young families with children under four renting in the area.

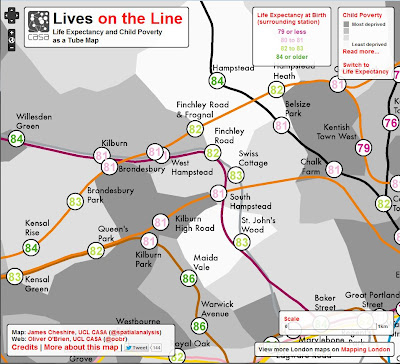

Neighbourhood

According to the English Housing Survey, 88% of Londoners are ‘satisfied’ with their neighbourhood. We’re sure most West Hampstead Life readers are more than ‘satisfied’ with their neighbourhood and reckon we’d score higher than average!

What’s interesting is that the London data shows a slight discrepancy in levels of happiness between those that rent and those that own their own home – but in our experience, this isn’t the case for West Hampstead. We’ve found that renters rarely leave the area and do so only if they want a complete change in lifestyle.

Local update

Stats aside, it’s been a slow start to the year. However, the change in the weather has helped both the sales and lettings markets; throughout March we’ve been contacted by vendors seeking pricing advice as well as tenants looking to move and settle before summer begins.

On the sales side, there’s a healthy demand from buyers looking for a first or a better home in and around West Hampstead. What’s noticeable though is how discerning buyers are being, and they’re certainly less prepared to compromise than they’ve been in the past.

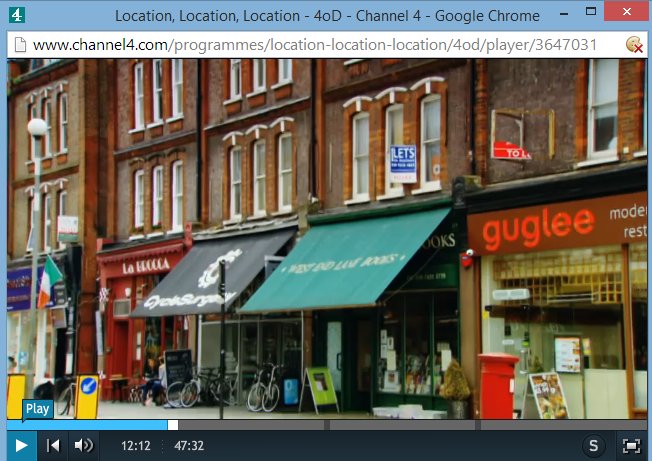

On the lettings side, we’ve noticed a lot of applicants moving from Hampstead and Belsize Park to West Hampstead. These tenants tend to be professional couples looking for extra value for money who now perceive West Hampstead at nearly the same level as Hampstead and Belsize Park. Naturally, we agree, and there’s no doubt that the significant improvements to transport infrastructure and amenities along West End Lane have helped shine a light on the area.

To get accurate market advice for your property, please do get in touch to arrange your personal market appraisal or pop in to see us at our West End Lane Office, on the edge of West Hampstead Square.

Jonny Miller and Matthew Spencer

T: 020 7481 2907

E: westhampstead@johnsand.co

W: www.johnsand.co

JOHNS&CO, Unit 7, Hardy Building, West End Lane, London, NW6 2BR

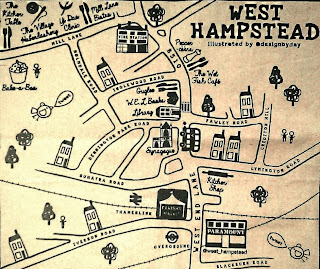

It can be easy to generalise when talking about the London property market. However, London has often been described as a collection of villages, each with its own unique style, atmosphere and charms. For this reason, when discussing the London property market, it’s important not to look at the capital as the sum of its parts but to understand that each borough is its own entity.

It can be easy to generalise when talking about the London property market. However, London has often been described as a collection of villages, each with its own unique style, atmosphere and charms. For this reason, when discussing the London property market, it’s important not to look at the capital as the sum of its parts but to understand that each borough is its own entity.

Tenants will be delighted at the announcement last week that administrative fees to tenants are to be banned, effective immediately. Whether costs to landlord might increase as a result is yet to be seen. Our view is that anything that can be done to improve transparency in our business has got to be positive. Flushing out the less scrupulous of our industry is what all good agents want to see happen. For tenants worried that this policy will result in an increase in rents, fear not, we can’t see this happening. We think that the industry is going to innovate around this to the benefit of tenants and landlords.

Tenants will be delighted at the announcement last week that administrative fees to tenants are to be banned, effective immediately. Whether costs to landlord might increase as a result is yet to be seen. Our view is that anything that can be done to improve transparency in our business has got to be positive. Flushing out the less scrupulous of our industry is what all good agents want to see happen. For tenants worried that this policy will result in an increase in rents, fear not, we can’t see this happening. We think that the industry is going to innovate around this to the benefit of tenants and landlords.

+gdn.jpg)

+kit.jpg)

+bed+1.jpg)

+ext.jpg)

+ext.jpg)

+recep.jpg)

+view.jpg)